Investing in the equity market can be a thrilling ride for many, combining the promise of higher returns with the excitement of watching companies grow and evolve. While the prospect of entering the stock market can seem daunting due to its volatility, there are compelling reasons to consider equity investments. Here’s a detailed look at why you might want to dive into the world of stocks.

1. Potential for High Returns

One of the most significant advantages of investing in equities is the potential for high returns. Over long periods, equities have historically outperformed other investment classes like bonds or savings accounts. By investing in companies with potential for growth, investors can reap the benefits as the value of these companies increases.

2. Diversification

Equities offer a fantastic way to diversify your investment portfolio. By spreading investments across various sectors and geographic regions, you can mitigate risk significantly. Diversification reduces the impact of a poor performance by one or a few investments, as other, more successful investments can balance them.

3. Liquidity

Stocks are generally highly liquid compared to other investments such as real estate or certain types of bonds. This means that you can buy and sell shares relatively quickly. Liquidity is a significant advantage if you need to convert your investments into cash or want to take advantage of fast-moving market opportunities.

4. Ownership in Companies

Buying shares means buying a part of a company. As a shareholder, you not only benefit financially from the company's growth but often also have the right to vote on important issues at shareholder meetings. This sense of ownership can be gratifying and empowering.

5. Dividend Income

Many companies distribute profits to shareholders in the form of dividends. This can provide a steady income stream and is particularly attractive for retired individuals looking for a consistent income. Dividends can also be reinvested to purchase additional shares, compounding your investment returns over time.

6. Hedge Against Inflation

Equities have the potential to provide returns that exceed the rate of inflation. This is crucial in maintaining the purchasing power of your money over the long term. By growing your capital at a rate that outpaces inflation, you effectively protect your wealth from eroding in value.

7. Tax Advantages

Investing in the stock market comes with certain tax benefits. For example, in some jurisdictions, capital gains are taxed at a lower rate than income. Additionally, dividends received may be tax-free up to a certain limit or taxed at reduced rates, depending on local tax laws.

8. Leveraging Technology and Information

The modern investor has access to an unprecedented amount of information and tools that can help in making informed decisions. From real-time data, detailed analyses, to predictive algorithms, technology empowers investors to manage their investments more effectively and make strategic choices.

9. Personal Growth and Learning

Investing in the stock market encourages continuous learning and personal growth. As you research stocks, learn about market trends, and track economic indicators, you gain valuable skills and knowledge that can benefit other areas of your life.

Conclusion

Investing in the equity market can be a rewarding strategy for growing wealth, especially if you are prepared to invest long-term. While it involves certain risks, the benefits of potential high returns, liquidity, and ownership in businesses make it a worthwhile consideration for any comprehensive financial strategy. Like any investment, it's essential to do thorough research and possibly consult with a financial advisor to tailor your investment choices to your personal goals and financial situation.

Andrea Barber Then & Now!

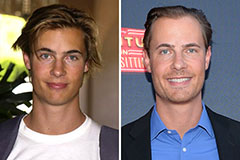

Andrea Barber Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Suri Cruise Then & Now!

Suri Cruise Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!